Your next move is a big decision and I want you to be comfortable knowing you have a trusted REALTOR® on your side.

The decision to rent or buy a home isn’t one-size-fits-all. With the 2025 market shifting and everyone’s financial goals looking a little different, it’s more important than ever to weigh the pros and cons of each. Whether you’re looking for flexibility or long-term stability, here’s a breakdown to help you figure out what’s right for you.

1. Financial Considerations

- Upfront Costs:

- Renting: Typically first month’s rent + deposit + application and processing fees. (These fees are depending on the home owner and the property management company)

- Buying: Down payment, closing costs, inspections, etc. These costs will normally be far larger than getting into a rental.

- Monthly Payments:

- Rent might be lower in the short-term, but mortgage payments build equity.

- Long-Term Investment:

- Homeownership can build wealth over time — renting won’t give you any return.

- Taxes & Maintenance:

- Homeowners handle property taxes and repairs; renters typically don’t.

2. Lifestyle Considerations

- Flexibility:

- Renting: Easier to move for a job, school, or just a change of scenery.

- Buying: More commitment, but also more control and personalization.

- Customization:

- Want to paint the walls or renovate the kitchen? Buying gives you that freedom.

- Renters are normally unable to change a home even if they feel it is for the better.

- Stability:

- Homeowners can lock in payments with a fixed-rate mortgage; renters may face rising rents and non-renewed leases.

3. The 2025 Market Snapshot

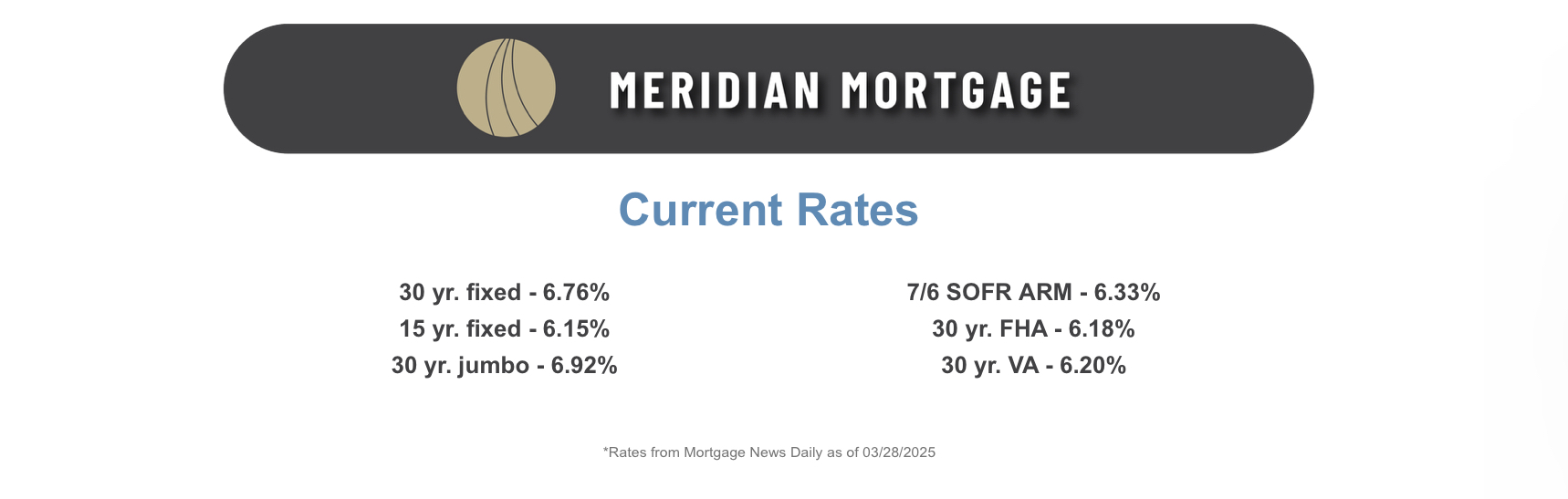

- Interest Rates:

- Still relatively high compared to a few years ago, but many buyers are finding creative financing solutions. Locking in now might be a good idea- If the rates drop you can refinance and if they raise, then you are locked in at a reasonable rate.

- Inventory & Prices:

- Depending on your area, buyers may be gaining more negotiating power as the inventory is high in most areas.

- Rental Market:

- In many cities, rents continue to rise, sometimes faster than home prices.

4. When Renting Might Be Right for You

- You’re planning to move again in the next 1–2 years

- You’re still building credit or saving for a down payment

- You want minimal responsibility for repairs and maintenance

5. When Buying Might Be the Better Move

- You’re ready to settle down in one place

- You have stable income and a good credit score

- You want to build equity and invest in your future

Final Thoughts:

There’s no universal “right answer” — it depends on your goals, lifestyle, and where you see yourself in the next few years. If you’re unsure which path to take, I’d love to help you talk through your options and see what makes the most sense in your situation. You can also see this calculator provided by CENTURY 21 which may give you some more insight one what could work better for you.

Let’s connect — whether you’re buying your first home, renting for now, or just starting to explore I can help with all avenues!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link