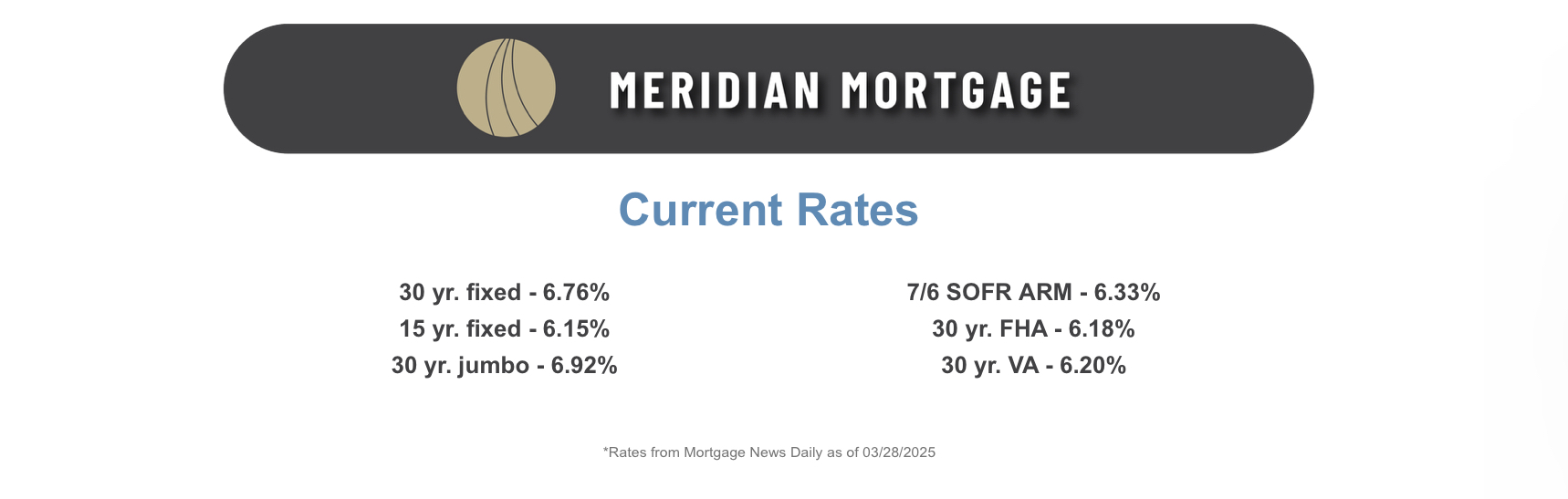

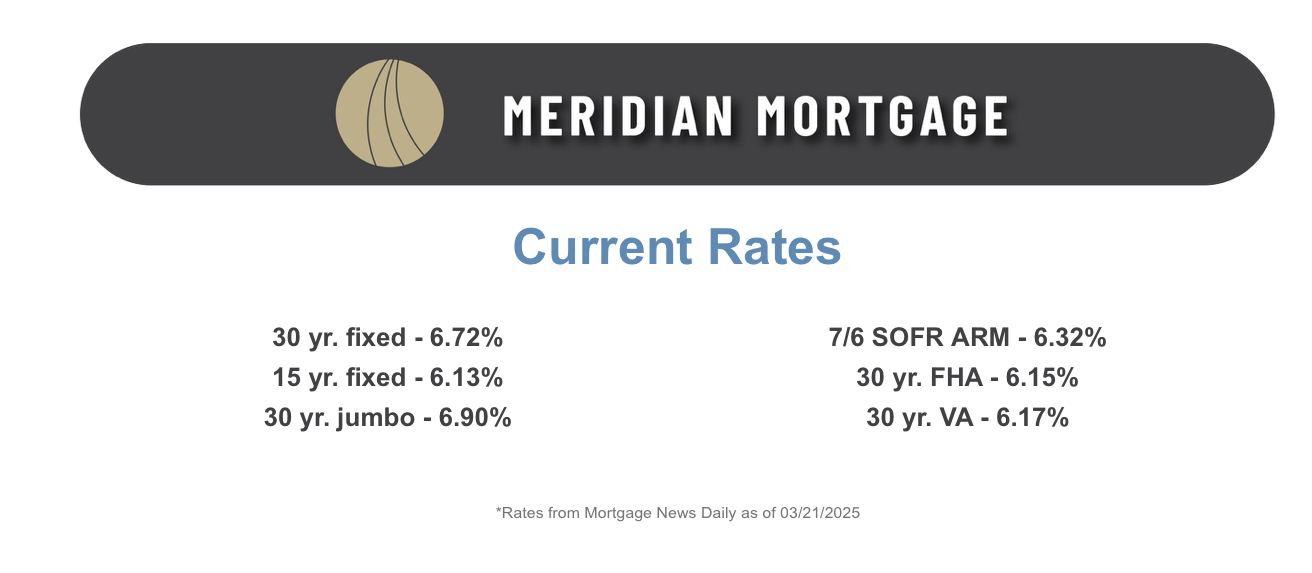

Let’s talk about the thing that’s got everyone nervous—interest rates. Yes, they’re higher right now. And no, it’s not 2020 anymore. But does that mean it’s a bad time to buy a home? Not necessarily.

I want to clear up some of the fear and confusion, because the truth is—it might still be the right time for you to buy, even in today’s market.

The Truth About Interest Rates

Right now, interest rates are definitely on the higher side compared to the last few years. But here’s something most people don’t realize: historically, today’s rates are still pretty normal. We just got spoiled by those ultra-low pandemic-era rates!

And guess what? The market hasn’t stopped. People will always find a reason to need a new home.

Why Buying Now Can Still Make Sense

Here’s why this might actually be a great time to buy:

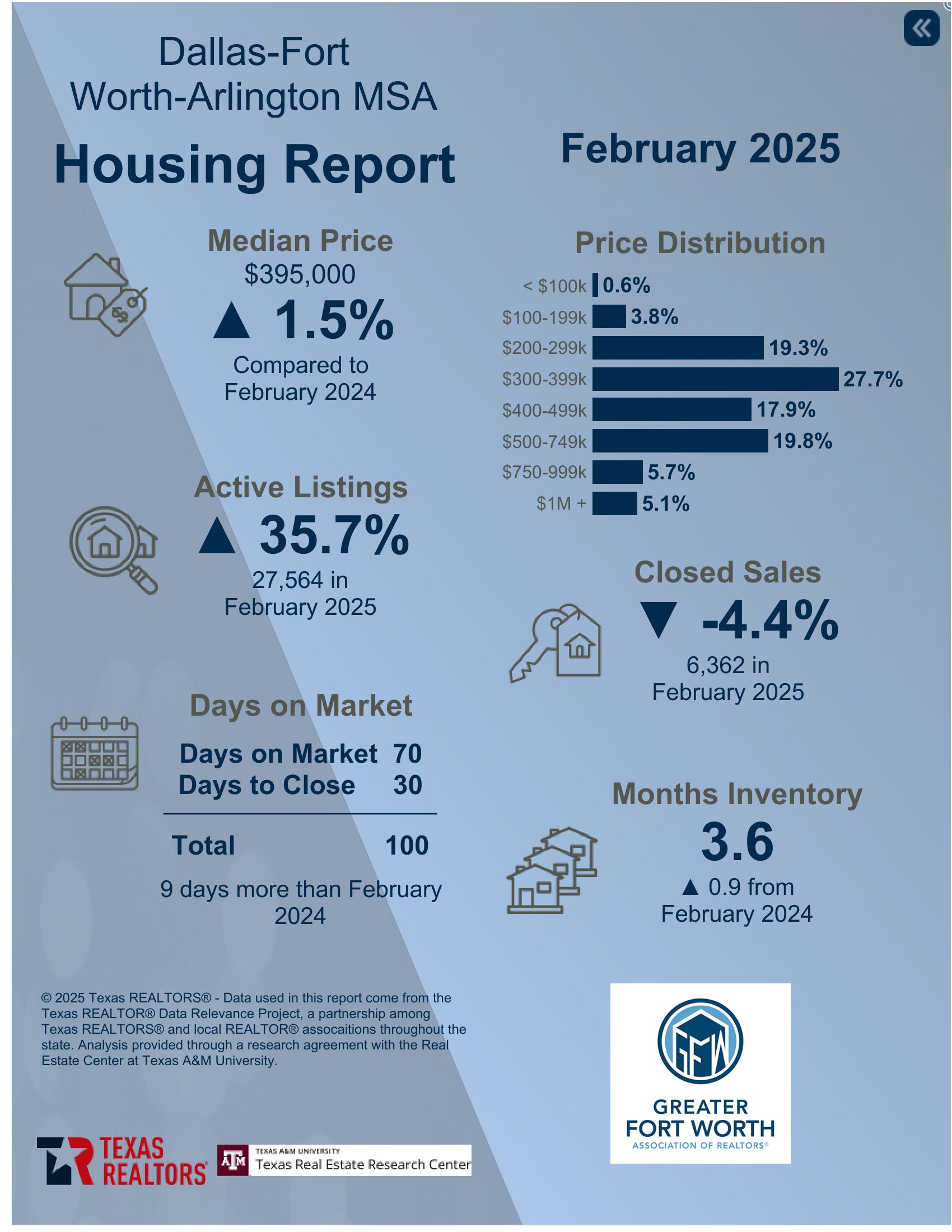

- Less competition – With some people hesitating, there’s more room for you to explore and negotiate.

- More inventory – In some areas, there are more homes to choose from, which means better chances of finding the right one.

- You can refinance later – You’re not stuck with your interest rate forever. When rates drop, you can refinance and lower your monthly payment.

- Renting won’t build equity – Even if your mortgage payment feels a little higher, you’re investing in your future—not paying off someone else’s.

Timing the Market vs. Your Own Timing

Trying to “wait out” the market might sound smart—but no one has a crystal ball. What matters more is your personal timing. Are you ready? Is it time for more space, more stability, or just something that’s truly yours?

If so, waiting might cost you more in the long run—especially if prices keep rising or the perfect home slips through your fingers.

Let’s Talk It Through

I get it—this market can feel a little overwhelming. But you don’t have to figure it all out alone. I’m here to walk you through every step, break it down in a way that makes sense, and help you make the best decision for you.

So if you’ve been wondering, “Should I wait to buy a home?”—let’s chat. Because the answer might be more encouraging than you think.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link