We’ve all done it—typed our address into Zillow just to see what pops up. It’s quick, it’s easy, and it feels official. But here’s the truth: those online “Zestimates” are just educated guesses, and they’re often way off from what your home would actually sell for.

Here’s why—and what really matters when it comes to pricing your home.

1. Zillow Doesn’t See Inside Your Home

Zillow’s algorithm might know your square footage, your lot size, and the number of bedrooms—but it doesn’t know your home’s story.

-

Maybe you just remodeled your kitchen with new appliances and granite countertops. That’s a huge value boost Zillow can’t see.

-

Or maybe the opposite: your home has water damage, an outdated interior, or repairs that need attention. Zillow isn’t going to knock the price down for that either.

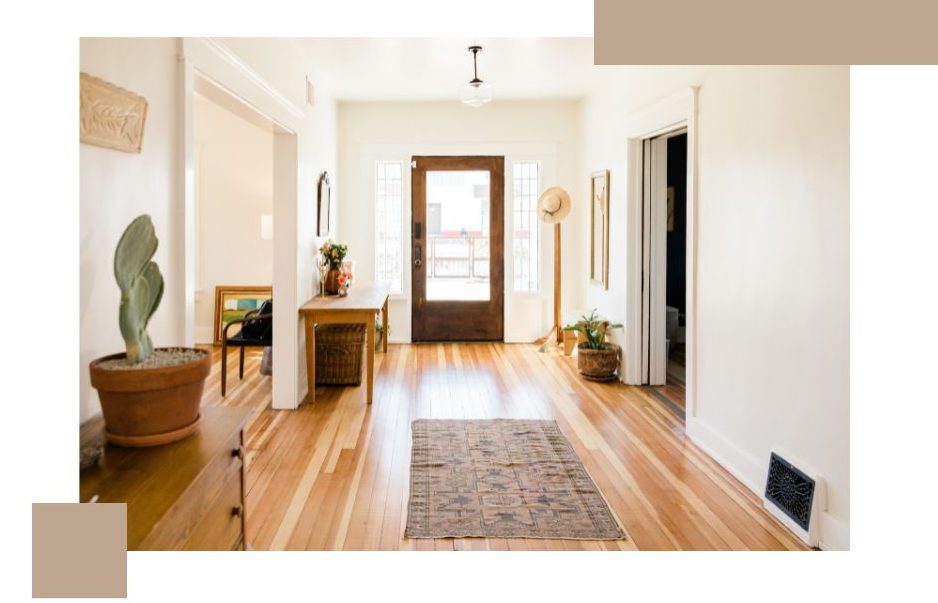

In other words, Zillow can’t peek behind the front door. It’s using data, not details, and those details are often what make (or break) a sale price.

2. Tax Appraisals Aren’t Market Value

Another common mix-up I see is homeowners thinking their property tax appraisal is the same as their home’s market value. It’s not.

The purpose of a tax appraisal is simple: to figure out how much to charge you in property taxes. That’s it. The county isn’t trying to sell your home, negotiate with buyers, or reflect what the market is doing today—they’re focused on setting a number that works for their revenue.

Because of that, tax values are often outdated and don’t consider recent upgrades, shifts in buyer demand, or even the actual condition of your home. Sometimes they’re higher than your home’s true value, sometimes lower—but rarely right on the money.

3. The Market Sets the Price

At the end of the day, your home is worth what a ready, willing, and able buyer will pay in today’s market. That means supply and demand, neighborhood sales, interest rates, and buyer confidence all matter way more than what Zillow (or your tax statement) says.

4. Comparable Sales (Comps) Are the Real Guide

When pricing a home, real estate professionals don’t just throw a number out there—we study comparable sales. These are homes in your neighborhood that have sold recently and are similar in size, style, and condition. From there, we make adjustments for things like square footage, upgrades, or even a bigger backyard. This method gives you the most accurate picture of what buyers will actually pay.

5. Overpricing Can Backfire

I get it—every seller wants the best possible price for their home (and you should!). But listing too high “just to see what happens” usually backfires. It can lead to fewer showings, longer days on the market, and eventually, price cuts. Buyers notice when a home sits too long, and they start to wonder if something’s wrong. Pricing your home right from the start gives you the best chance to sell quickly and for top dollar.

Bottom Line: Zillow and tax records are good for curiosity, but they aren’t a pricing tool. If you really want to know what your home is worth, a local market analysis from a real estate professional will always tell the truer story.

Curious what your home might actually sell for in today’s market? I offer free home evaluations where I run a full market report and then meet with you to go over the results in detail. No guessing games—just clear, local data tailored to your home.

Click here to request your free home evaluation

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link